Binance, the world’s largest crypto exchange by trading volume, suffered a wave of withdrawals on Monday amid concerns over its proof-of-reserve report.

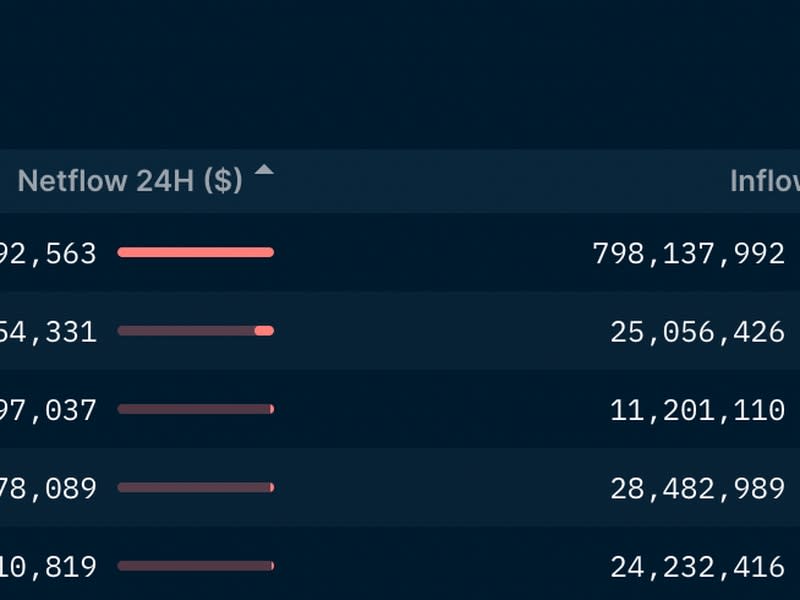

Net outflows, the difference between the value of assets entering and leaving the exchange, reached $902 million in the past 24 hours, according to data from the blockchain intelligence platform Nansen.

Binance’s net outflow exceeded that of all other centralized exchanges in the last 24 hours and was almost nine times larger than the second largest outflow.

The outflow was the highest for Binance since November 13, two days after FTX has filed for bankruptcy protectionaccording to data provided by the Arkham Intelligence blockchain data platform.

However, the leak “doesn’t seem particularly anomalous,” Arkham analyst Henry Fisher wrote in a Telegram chat, given that there is seemingly $64 billion in assets on Binance.

Withdrawals surged following a series of troubling news about Binance and as investors grew more wary of their funds on a centralized exchange. The rapid collapse of rival exchange FTX, compounded by other failures in the industry, prompted other exchanges to prove they were protecting clients’ assets.

Criminal charges against Binance?

Binance launched report of the audit firm Mazars last week claiming it was Bitcoin (BTC) reserves are oversecured. Industry experts and recent reports skinned the document for its narrow scope, and on Monday Reuters reported that US prosecutors are considering criminal charges of possible money laundering against Binance and its executives, including Zhao.

Binance did not respond to a request for comment. Changpeng Zhao, founder and CEO, urged his followers to “ignore FUD” – crypto jargon for spreading fear, uncertainty and doubt – in a tweet.

Read more: Binance suspends customer’s account for being ‘unreasonable’

Blockchain data shows that major crypto market makers Jump Trading and Wintermute are among those who have transferred significant funds from Binance in the past seven days.

Jump Trading appears to be the biggest mover from Binance, Nansen analyst Andrew Thurman wrote in the a tweet.

Net exchange withdrawals from crypto wallets linked to Jump reached $146 million in digital assets over the past seven days, data compiled by Nansen shows.

Jump’s net withdrawals include $102 million in Binance USD (BUSD), an exchange stablecoin issued by Paxos; $14 million from Tether’s USDT; and $10 million Ether (ETH).

Jump bought about $30 million from Binance USD (BUSD) by Paxos a few hours ago, on blockchain data from Arkham.

Wintermute, another major crypto market maker, withdrew $8.5 million in wrapped bitcoin (wBTC) and $5.5 million USDC on Circle stablecoin.

As of press time, Jump Trading and Wintermute had not responded to CoinDesk’s requests for comment.

Wintermute recognized in a tweet on Nov 9 that some funds remained in Sam Bankman-Fried’s FTX crypto exchange, which collapsed last month in spectacular fashion. Jump Trading tweeted on November 12. that the firm remains well capitalized, but did not specify losses or capital exposure to FTX.