Is China’s zero-Covid strategy finally over? While most Western nations have prioritized a return to normality and an end to the restrictions imposed by the COVID pandemic, China has stood out for maintaining its highly restrictive lockdown policies. But there is growing evidence that Beijing is looking for a way back from the lockdowns – and Chinese policymakers appear to be aiming to reopen their economy.

That’s good news for investors, as the move away from zero COVID controls in major cities like Shanghai and Shenzhen is likely to provide strong support for Chinese stock markets — and for Chinese companies traded abroad.

In a note from banking giant Morgan Stanley, chief China equity strategist Laura Wang wrote: “A number of positive developments, along with a clear path to reopening, warrant an upgrade and increase in the index’s China target… Our bottom line is that we are at the start of a multi-month recovery in earnings revisions and valuations with a decent improvement in ROE.”

Against this background, stock market analysts at Morgan Stanley have picked two Chinese stocks as likely winners in the coming year. According to the firm’s analysts, these are Buy-rated stocks that offer investors double-digit upside potential. We spent the two of us TipRanks database to see what other Wall Street analysts have to say about them.

Kanzhun, Ltd. (B Z)

One change that the digital world brought was the migration of job hunting online. Kanzhun is a Chinese company providing, through its subsidiaries, online recruitment services – a manpower company serving the manpower needs of China’s business sector. The company connects job seekers and corporate clients for the benefit of both, and strives for a seamlessly efficient service profile. Connections are made primarily through Kanzhun’s interactive mobile app and connects white-collar, blue-collar and student-level job seekers across a wide range of industries.

China’s COVID lockdown has put pressure on the economy as a whole, and Kanzhun’s third-quarter results, which showed a 2.7% year-on-year decline in revenue, reflect that. The top line was $165.7 million in US currency. Profits were also down, with adjusted net income falling 2.2% to $52.9 million.

While the top and bottom lines were down, the company saw a small gain in cash payments, which rose 1.4 percent to $174.1 million. Even better, from an investor’s perspective, Kanzhun reported a strong increase in average monthly active users. This key indicator grew by more than 12% year-on-year to reach 32.4 million, and bodes well for China’s labor market going forward. The gain in average MAU more than offset a 7.5% decline in total paid enterprise customers.

Among the bulls, the Morgan Stanley analyst Eddie Wang which believes that Kanzhun could “generate the strongest revenue and profit growth in China’s Internet industry in 2022-25.”

“We believe that BZ can achieve stable revenue growth over the next few years, supported by increasing penetration of enterprise users and improving the payout ratio by leveraging a strong network effect,” Wang said. “With an asset-light business model, its margins should improve with monetization. Thus, we believe it can also generate strong non-GAAP net income growth.”

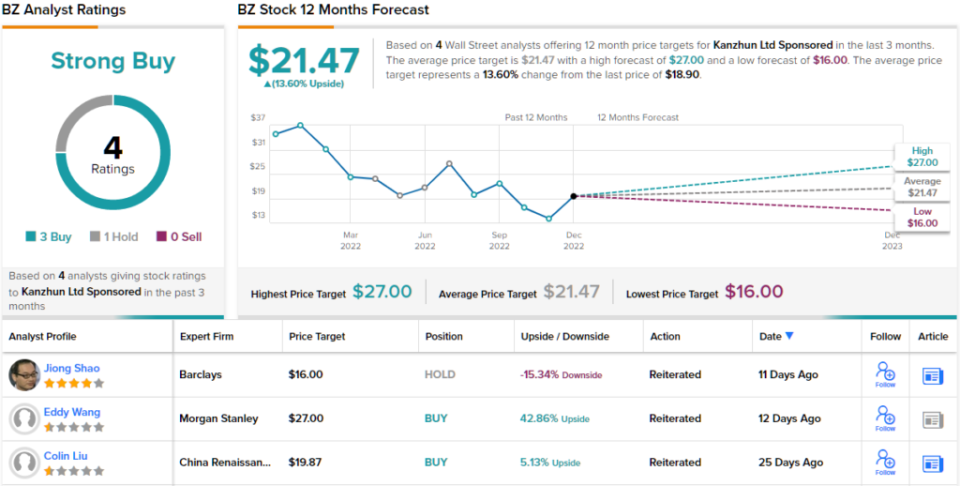

These comments support Wang’s Overweight (ie, Buy) rating on the stock, and his price target, set at $27, indicates his belief in the stock’s 43% upside potential over the next year. (To watch Wang’s record, Press here)

In total, Kanzhun collected 4 recent Street analyst reviews recently and they include 3 for Buy versus just 1 for Hold – for a strong consensus Buy rating. (See the Kanzhun stock forecast at TipRanks)

ZTO Express (ZTO)

The next Morgan Stanley-backed Chinese name we’ll look at is ZTO Express, one of the country’s leading express delivery companies. ZTO has made a name for itself as an express delivery partner for millions of online merchants and consumers selling and buying products on leading Chinese e-commerce sites such as Alibaba, PDD and JD.com. The company touts its highly scalable network affiliate system as allowing it to quickly grow its nationwide network while offering e-commerce merchants better and more affordable geographic reach.

Despite concerns about slower industry volume growth, the company delivered a strong third-quarter report. Revenue increased 21% year over year to $1.26 billion. At the same time, sales grew at a faster rate than operating expenses – which rose just 11.6% – allowing the company to post 65% profit growth in the quarter – making it the most profitable delivery company parcels to China in the third quarter—no mean feat in an industry considered extremely competitive. After all, ZTO generates adj. EPS of $0.33, while the Street was calling for $0.27.

Covers shares of Morgan Stanley, analyst Qianlei Fan wrote that he remains optimistic about ZTO, including among the reasons: “(1) We still believe that ZTO’s established advantages in unit profit, scale and quality of service will bring a continued ability to invest in capacity, to obtain additional volume on the market. (2) We believe that ZTO’s focus on network stability and profitability is likely to result in higher earnings predictability and better quality of service.”

These reasons underlie Fan’s Overweight (i.e. Buy) rating, while her average target of $30.50 is set to generate an 18% return over the next year. (To watch Fan’s record, Press here)

Two other analysts track ZTO’s recent progress, and like Morgan Stanley, they like what they see, giving the name a consensus rating of Strong Buy. (Check out the ZTO Express stock forecast at TipRanks)

To find good stock trading ideas at attractive valuations, visit TipRanks’ The best stocks to buya tool that brings together all of TipRanks equity insights.

Rebuttal: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.