As we approach the final quarter of 2022, investors are looking for an answer to one question: Was June’s bottom the bottom for stocks, or do they still have room to go? This is a serious question and may not have an easy answer. Markets are facing a series of headwinds, from the high inflation and rising interest rates we’ve come to know, to an increasingly strong dollar that will put pressure on upcoming third-quarter earnings.

Weighing in on current conditions from Charles Schwab, an $8 trillion brokerage firm, Chief Global Investment Strategist Jeffrey Kleintop notes these key factors on investors’ minds before coming down firmly in favor of a bullish position on high-yield and dividend stocks.

“We’re talking about the characteristics of stocks that outperform across sectors, and they tend to be value drivers and high quality drivers. What I’ve focused on the most lately is high dividend payments… They’ve done incredibly well, and usually a high dividend is a sign of good cash flow and a good balance sheet, and investors are looking for that,” Kleintop noted.

So let’s take a look at two of the market’s dividend champs, the high-yielding dividend payers that Street analysts like. According to TipRanks databaseboth stocks have a strong buy rating from the analyst consensus – and both offer dividends of up to 8%, high enough to offer investors some degree of inflation protection.

Ares Capital Corporation (ARCC)

First up is Ares Capital, a business development company (BDC) focused on the SME sector. Ares provides access to capital, credit and financial instruments and services to companies that would otherwise have difficulty accessing services from large banking firms. Ares’ target customer base is the small businesses that have long been the engines of much of the US economy.

On a macro level, Ares has outperformed the overall markets so far this year. The company’s shares are down – but only by 3% since the beginning of the year. That compares favorably with the S&P 500’s 16% loss over the same time frame.

Ares achieved this excellence through the quality of its investment portfolio. The company’s portfolio at the end of 2Q12 had a fair value of $21.2 billion and consisted of loans and equity investments in 452 companies. The portfolio is diversified across asset classes, industries and geographies, giving it a strong defensive position in today’s uncertain market environment.

The company reported total investment income of $479 million in the second quarter, an increase of $20 million, or 4.3%, from the prior quarter. That resulted in GAAP net income of $111 million and underlying EPS of 46 cents.

The latter two results were down year-over-year but were more than enough to fund the company’s dividend, which was announced in July at 43 cents per common share, payable on September 30. The dividend is growing year-over-year to $1.72 and yields 8.7%. In addition to the common stock dividend, the company will also pay a previously authorized special dividend of 3 cents. Ares has a history of maintaining reliable quarterly dividends since 2004.

I cover Ares for Truist, an analyst Michael Ramirez described the firm’s recent quarterly earnings as “affected by greater market volatility”, which led to “better attractive conditions for new products combined with higher earnings – leading to confidence to increase the regular dividend”.

Looking ahead, in more detail, Ramirez added: “We continue to expect the improvement in NII to provide a cushion between earnings and the regular and additional dividend in the second half of 2022. We also expect total portfolio returns to benefit from the higher short-term outlook interest rates, with current Fed Fund futures expecting rate hikes of approximately 200 basis points in the second half of 2022.”

The analyst’s comments point to further upside – and he backs them up with a Buy rating on the stock and a $22 price target, indicating confidence in one-year growth of 12%. Based on the current dividend yield and expected price appreciation, the stock has a ~21% potential total return profile. (To watch Ramirez’s record, Press here)

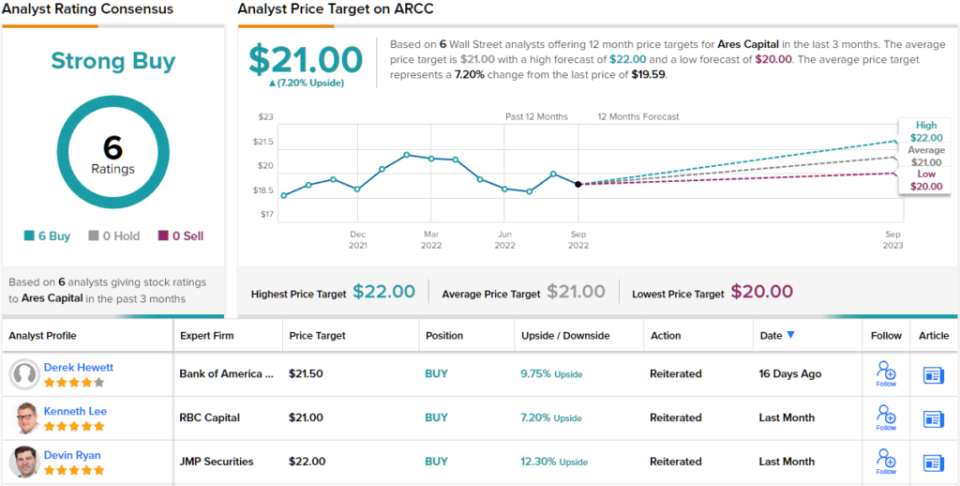

Overall, ARCC’s Strong Buy consensus rating is unanimous, based on 6 positive analyst reviews given in recent weeks. Shares are valued at $19.59, and their current price target of $21 suggests a modest 7% gain from that level. (See the ARCC stock forecast at TipRanks)

The Williams Companies (WMB)

The next company we’ll look at, Williams Companies, is a major player in the natural gas pipeline. Williams oversees natural gas, natural gas liquids and oil gathering pipelines in a network that stretches from the Pacific Northwest, through the Rocky Mountains to the Gulf Coast and south to the Mid-Atlantic. Williams’ primary business is the processing and transportation of natural gas with crude oil and power generation as secondary operations. The company’s footprint is huge—it manages nearly a third of all U.S. natural gas consumption, both domestic and commercial.

The firm’s natural gas business delivered strong results in revenue and earnings. The most recent quarter, 2Q22, saw total revenue of $2.49 billion, up 9% year-over-year from the $2.28 billion reported in the year-ago quarter. Adjusted net income of $484 million led to adjusted diluted earnings per share of 40 cents. That EPS was up 48% year-over-year and well above the forecast of 37 cents.

The rising price of natural gas and solid financial results have boosted the company’s shares – and while the broader markets are down since the start of the year, WMB shares are up 26%.

The company also pays a regular dividend, and in its most recent filing in July for a payout on Sept. 26, management pegged the payout at 42.5 cents. This marks the third consecutive quarter at this level. The dividend is up on an annualized basis to $1.70 and a yield of 5.3%. Even better, Williams has a history of maintaining reliable dividend payouts — never missing a quarter — dating back to 1989.

This action attracted the attention of Justin Jenkins, a 5-star analyst at Raymond James, who wrote about WMB: “The attractive combination of core business stability and operating leverage of The Williams Companies (WMB) through G&P, marketing, production and project execution is still undervalued. WMB’s large cap, C-Corp., and natural gas demand-focused characteristics (and supply tailwinds in several G&P regions and Deepwater) position it well in both the short and long term, in our view. Potential buybacks and JV optimization offer additional catalysts throughout the year, reinforcing the expected premium valuation.”

Jenkins continues to give WMB stock a Strong Buy rating, and his $42 price target suggests 31% upside over the next 12 months. (To watch Jenkins’ record, Press here)

Jenkins disagrees that he sees Williams as a strong buy; this is the consensus estimate based on 10 recent analyst surveys, which include 9 buys and 1 sell. The stock has an average price target of $38.90, suggesting a ~22% one-year gain from the current trading price of $32. (Check out the WMB stock forecast at TipRanks)

To find good ideas for trading dividend stocks at attractive valuations, visit TipRanks’ The best stocks to buya recently launched tool that brings together all of TipRanks equity insights.

Rebuttal: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.