As the summer draws to a close, the US stock market is poised for a potentially volatile decline.

“Recession fears are the most likely reason for a retest of the June lows,” Ed Clissold, chief U.S. strategist at Ned Davis Research, said in an Aug. 31 note. “In terms of the season, a retest could come in the next couple of weeks.”

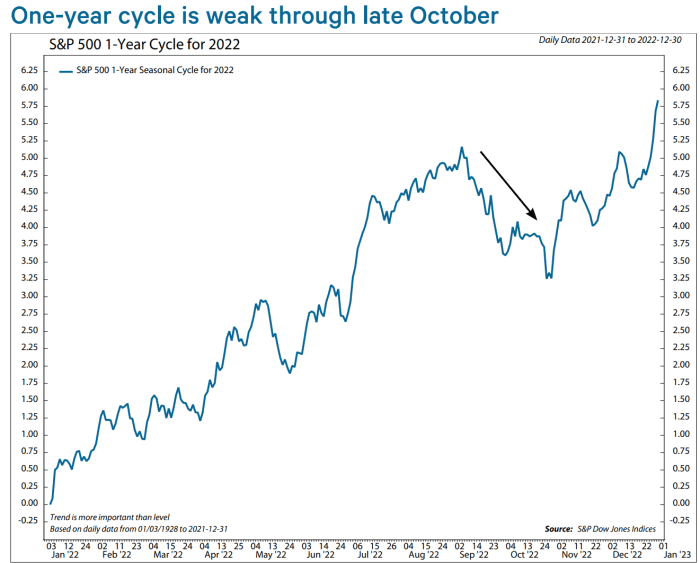

When U.S. investors return from the long Labor Day weekend, history suggests they will face the weakest period of the year for the S&P 500: the stretch from Sept. 6 to Oct. 25, according to the note.

NED DAVIS INVESTIGATION REPORT DATED AUG. 31, 2022

The stock market is already volatile.

US stocks closed sharply lower Friday, with all three major benchmarks suffering a third straight week of losses. The S&P 500 though

SPX,

closed 7 percent above its 52-week low of 3,666.77 on June 16, according to Dow Jones Market Data.

“I think we need to go back and test that level,” Bob Dole, chief investment officer of Crossmark Global Investments, said in a telephone interview. “I don’t think the bear market is necessarily over,” he said, although “what I don’t see is a huge downside from here.”

Read: ‘Brace for epic finale’: Jeremy Grantham warns ‘tragedy’ looms as ‘superbubble’ could burst

Meanwhile, continued interest rate hikes by the Federal Reserve to combat rising inflation in the slowing US economy are raising the odds of a recession along with the prospect of this year’s stock market lows being retested, according to a note by Ned Davis. The Federal Reserve this year is “committed to removing liquidity from the financial system,” making a retest more likely, Clissold wrote.

Vanguard Group said in September 1 report that it cut its forecast for US economic growth this year after two straight quarters of contraction. The firm now expects economic growth of 0.25%-0.75% for all of 2022, down from its estimate last month of around 1.5%.

“We believe the United States is likely to struggle to regain above-trend growth in the coming quarters,” Vanguard said. “We put the probability of a US recession at about 25% over the next 12 months and 65% over the next 24 months.”

Whether any “retest” of stock market bottoms is short-lived may depend on the US’s ability to avoid recession, according to Ned Davis.

“The average non-recessionary bear has lasted about seven months and is down 25% (-18% over the past half-century), putting the January-June decline in line with the typical case,” Clissold wrote in the Ned Davies note. “In contrast, the average recession has lasted about a year (17 months over the past 50 years) and has contracted by an average of 35%.”

Inflationary “dragon”

Investors expected another big rate hike from the Fed at its Sept. 20-21 meeting after Chairman Jerome Powell sent a clear message in his Aug. 26 Jackson Hole speech that the central bank will continue to fight high inflation until the job it was done – even if it meant some pain for households and businesses.

Stocks fell on his remarks that day, with the Dow Jones Industrial Average

DJIA,

closing 1000 points and losses have deepened since then.

The “vigorous” rally in stocks seen earlier in the summer reflected “too much optimism given that we are still in the early stages of fighting inflation,” Crossmark’s Doll said. Although he thinks inflation has peaked, Dole predicts that its continued decline this year will likely be erratic and end 2022 above the Fed’s 2% target.

“It’s not going to get to a level where we say, ‘okay, we’ve got this dragon, what’s next’?” he said. If inflation, which reached 9.1% in June based on the consumer price index, comes down to 4% or 5%, “that’s good news, but not good enough news to say the Fed has done a job,” Dole said.

Vanguard expects the Federal Reserve to raise its target for the federal funds rate to a range of 3.25%-3.75% by the end of the year, from near zero in early 2022, according to its note. This is compared to a current range from 2.25% to 2.5%.

In front of Powell Jackson Hole speech, the market narrative had shifted from the Federal Reserve fighting inflation through aggressive rate hikes to “when are they going to turn around?” said Steve Sosnick, chief strategist at Interactive Brokers. But using a relatively short speech in which there was “no ambiguity,” Powell shifted the focus back to monetary tightening and the Fed’s unfinished fight with inflation, sending “a very strong message to the market,” Sosnick said.

“We’ve been dealing with it ever since,” he said, pointing to stock market losses.

“The fact that we’ve moved so quickly and the psychology has changed so quickly makes me think we’re far from the last of the volatility, especially in the fall,” Sosnick said. “The September-October period definitely gets more than its share of market quirks.”

The bottom of the stock market?

Equity and quantitative strategists at Bank of America said in a Sept. 2 BofA Global Research note that valuations for the S&P 500 remain “rich.” According to them, “the bottom is not in.”

“Initially, the rally from the June lows looked more like a young cyclical bull than a bear market rally,” Clissold said in the Ned Davis note. “Several broadside pushes and the extension of new highs suggest that much of the decline has run its course.”

But medium- and long-term range needed to follow to confirm a bull market, he said, and without that confirmation “a retest cannot be ruled out.”

“The S&P 500 stopped just below its bearish 200-day moving average and gave up about half of its gains from June 16 to August 16,” Clissold wrote. Also, “the percentage of stocks above their 50-day moving averages just missed their 90% threshold.”

U.S. stocks ended Friday with weekly losses, as did the S&P 500

SPX,

losing 3.3%, while the Dow Jones Industrial Average

DJIA,

fell 3%, and the tech-heavy Nasdaq Composite

comp,

down 4.2%.

The US stock market will take off on Monday to celebrate Labor Day, resuming trading on Tuesday. The economic calendar for the week ahead includes data on US services, jobless claims and consumer credit, as well as the release of Fed data “beige book,” which features a collection of business anecdotes from around the country.

Continued aggressive rate hikes by the Fed, combined with looming weakness in corporate earnings and the labor market, “is not a strong backdrop for the stock market,” Liz Ann Saunders, chief investment strategist at Charles Schwab, said by telephone. Also, “we know that September, seasonally, tends to be a weak month” for stocks.