– by a New Deal Democrat

This morning’s JOLTS report for January, in contrast to the recent wage report, generally showed further softening in the labor market.

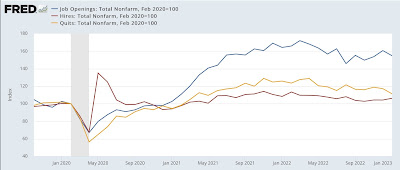

While hiring (red in the chart below, normalized to 100 as of February 2020) increased by 121,000, departures (gold) decreased by 207,000 and vacancies (blue) decreased by 410,000:

Most noticeable is the downward trend in leaving. Since employees voluntarily leave more the more confident they are about new job prospects, this is a clear sign of a *relative* slack. The increase in hiring is more of a flattening of a trend that has been slowing. The trend in openings does look softer, although given the increase in the last few months before January, this is more doubtful.

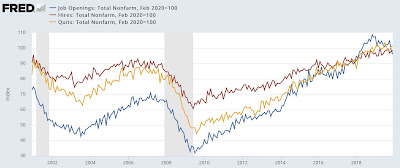

For comparison, here’s the same graph spanning the period from the start of the series to 2019:

Note that all three appear to have weakened just prior to the 3 recessions since 2000; but vacancies continue to increase on a secular basis. That companies may have maintained job postings even when they were not actively looking, but only to solicit resumes; and further that this conduct is likely to have spread throughout the industry; is one of the reasons I don’t value this series as much as others. Still, the general trend is a useful indicator of the state of the labor market.

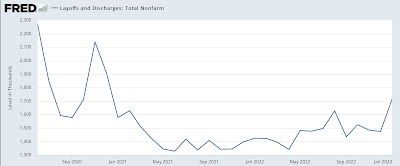

Finally, layoffs and layoffs rose sharply by 241,000 in January to their highest level since October 2020:

Here is their pre-pandemic record:

Note that the current level of layoffs and layoffs would have been very good for any period from 2000 until the pandemic hit.

To summarize: January’s JOLTS report is broadly consistent with a continued very strong labor market, but one that is softening against even higher levels in 2021-22.

The weakening of this report, especially on the jobs front, is one of the main indicators I’m looking at for evidence that broader employment indicators are starting to capitulate. I don’t think this report puts us there in any meaningful sense. However, in Friday’s jobs report, I will focus most closely on whether employment in three leading sectors – temporary jobs, manufacturing and housing – either remained negative (for the first sector) or turned negative (for relation of the last two) .