– by a New Deal Democrat

As I have said many times over the last 10 years, housing prices lag sales. Permits and housing starts peaked in early 2022, and home prices followed in the summer.

This morning, the FHFA and Case Shiller home price indexes for December showed continued declines on both a monthly and annual basis, continuing to portend a similar decline in the shelter CPI for the rest of this year.

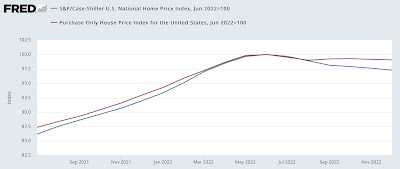

Here’s what both look like normalized to 100 at their June peaks:

Since then, the FHFA index is down -0.9% and the Case Shiller National Index is down -2.7%.

Note that between June 2020 and June 2022, both indexed indices increased by over 1% per month on average, but decreased at a much slower rate. In other words, post-pandemic home prices skyrocketed, but to date they’ve only drifted down like a feather.

Year-over-year comparisons, on the other hand, get much better. At their peaks in the spring of 2022, both house price measures were up about 20% year over year. As of December, the FHFA is down +6.6% y/y and the Case Shiller index is +7.6% y/y:

If this pace continues, year-over-year prices will decline later this spring.

As I’ve pointed out for more than a year, house prices have been leading the CPI measure of owner-occupier equivalent rent by 12 months or more. Here is the most recent 20-year history of the annualized % change in the FHFA index (red, /2.5 for scale) versus the annualized owner-equivalent rent (blue):

The good news is that the CPI measure for housing remains on track to fall to around 3%-3.5% on an annualized basis through the end of 2023, close to, if not within, which should be the Fed’s comfort range.

Unfortunately, we probably still have a few months before the official CPI measurement for shelter tops, probably at 8.0% or more.

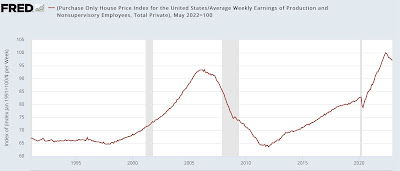

Finally, let’s look at households’ ability to make the down payment (leaving mortgage interest aside for this purpose). As shown in the chart below, which normalizes home prices to the average weekly wage for non-supervisory workers, home prices are still only -3.0% below their all-time highs set last May:

So even if prices fall further this year, which is likely, housing will still be very expensive relative to historical norms.