– by a New Deal Democrat

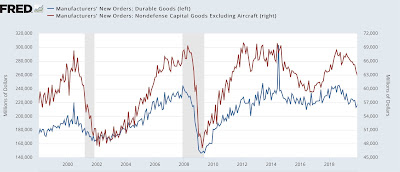

I usually don’t pay much attention to durable goods orders. This is because they are very noisy. They don’t always give up before the recession (see 2007-08), although they may at least stop, and there are also a number of false positives (see 2016), as shown in the chart below, showing up to pandemic:

But in 2022, they were one of the last short leading indicators to be positive. Until last November I still rated them as “positive”.

That has changed somewhat in the past few months. With the exception of December, durable goods orders have seen no progress at all since last June, and while “core” durable goods orders excluding aircraft (Boeing) and defense increased in January, they remained below last August’s level and generally flat since then too:

The year-over-year outlook shows that both durable goods measures are slowing, but neither has worsened as much as before the last 3 recessions:

But if they continue at their current pace of deceleration, core capital goods will be negative on an annual basis around mid-year.

This has been a dominant theme in the data – especially some short leading and matching indicators – over the past few months: continued slowdown but not yet turning negative.