– by a New Deal Democrat

No major economic news today. Existing home sales were released yesterday, but their economic impact is not that important, except that it may confirm what is happening with new homes under construction. And that gave us confirmation.

First, housing *sales* bottomed out after mortgage rates peaked above 7% late last October.

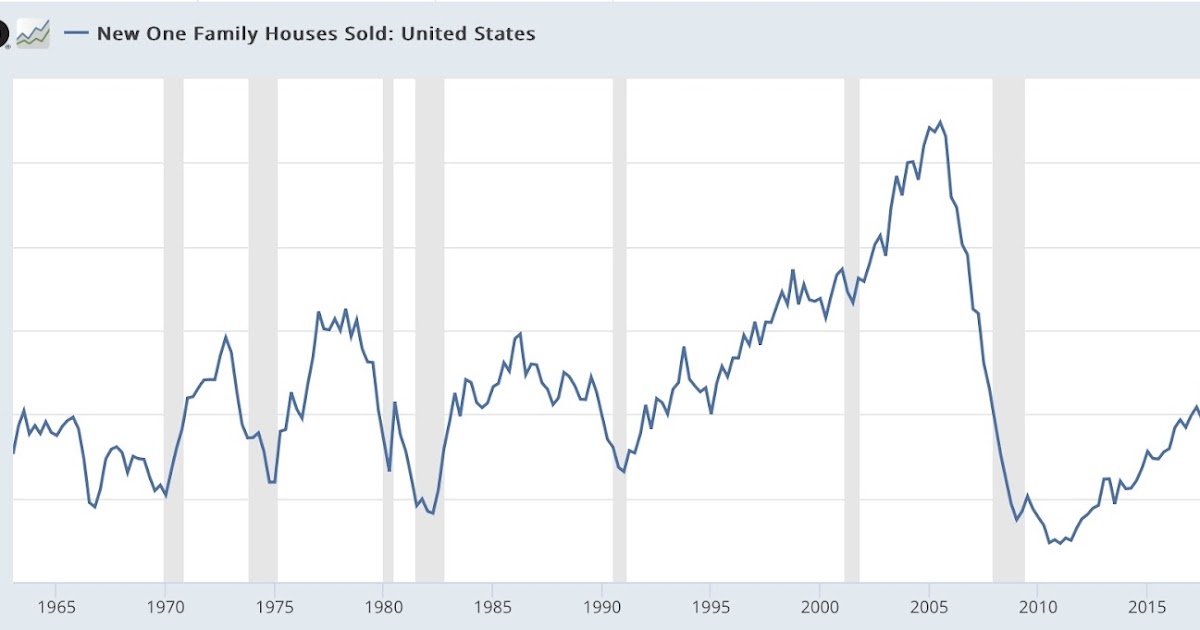

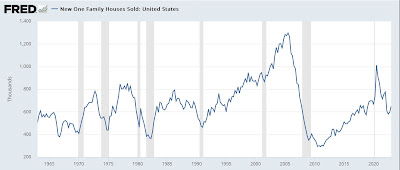

New home sales (which will be released for April on Monday) were, as is often the case, the first to turn around after bottoming out last July:

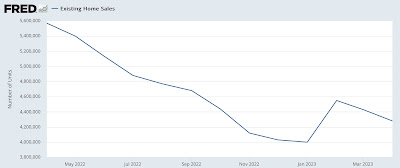

Existing home sales yesterday remained above their January bottom by a significant margin:

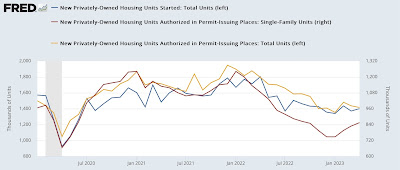

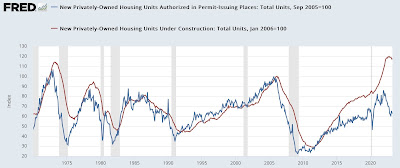

With one exception, permits and new housing starts, as reported earlier this week, also bottomed out in January:

As shown above, the big jump came in separate family units. Although multifamily starts continue to slowly increase, permits for multifamily units hit a new low:

This suggests that multifamily units under construction have a long way to go before giving up. As noted the other day, total units under construction are down, but not by much:

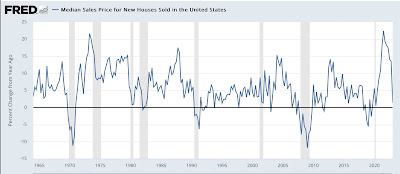

As for prices, we have to measure mainly on an annual basis, as a small part of the data is seasonally adjusted.

Yesterday it was reported that existing home prices fell by -1.7%. The past two months were the first year-over-year declines since the end of the housing bust more than 10 years ago:

Average new home prices rose to +3.2% on a year-over-year basis, following a month of year-over-year declines in January. The chart below is quarterly averaged to reduce noise:

Here the number is +1.4%.

The FHFA and Case-Shiller resale indexes were only updated in February and show a sharp slowdown year-over-year, but are still up 4.0% and 2.0%, respectively:

These two resale indices are seasonally adjusted and show very slight declines of less than 1% and less than 3% respectively:

In absolute terms, prices may also have bottomed.

The resale indexes will be updated for March on May 30.