– by a New Deal Democrat

I neglected to add a link to my Weekly Indicators material in Seeking Alpha on Saturday, so Here it is.

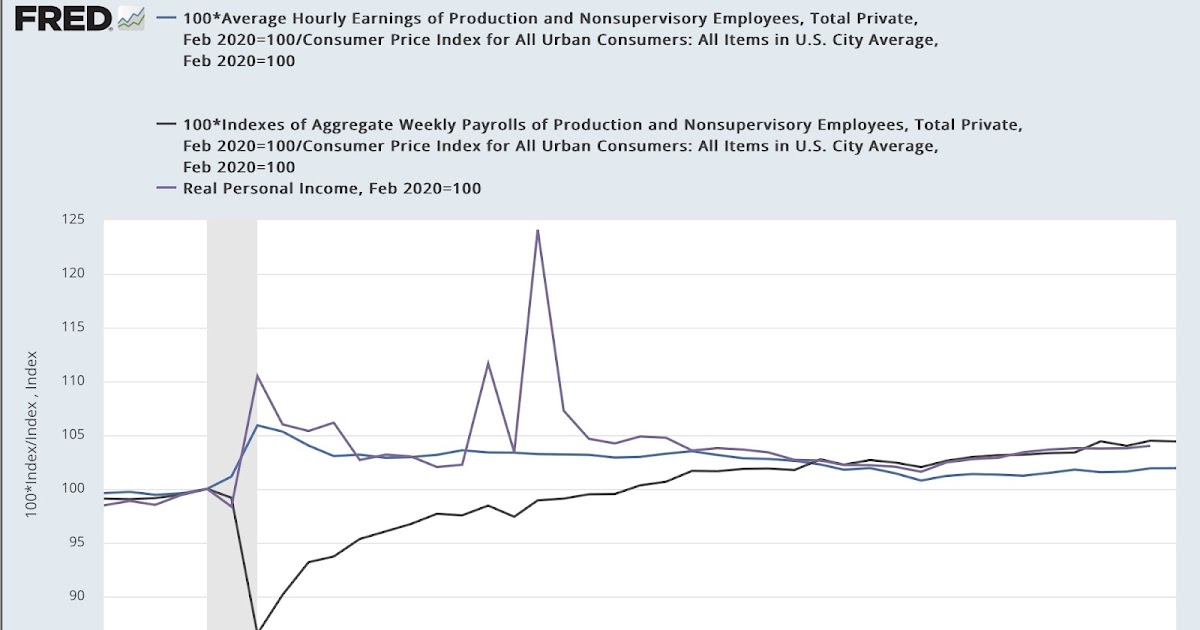

First of all, yes, average working Americans and middle-class Americans are outpacing inflation, especially measured since before the pandemic began, as this first graph below does for real average hourly earnings (blue), real aggregate wages (purple), and real personal income (grey):

Real average hourly earnings increased by 1.9% compared to just before the pandemic, real aggregate wages increased by 4.5%, and real personal income increased by 4.0%.

And as the long-term chart below shows, all three of these measures are at new highs compared to any time before the pandemic:

So to reiterate: yes, average Americans have fared significantly better financially since the start of the pandemic, thanks in large part to two rounds of stimulus in 2020 and 2021 that acted as bridges between that part of the economy (restaurants and entertainment venues) was largely closed.

But now . . . Let’s put this in perspective of how well corporations have fared since the pandemic.

The first graph below is exactly the same graph as the first above, but with the addition of after-tax corporate profits (in red), also deflated using the CPI for uniformity):

Suddenly, those consumer gains are dwarfed as corporate profits are up more than 80% from their peak just before the pandemic and are still over 50% higher.

And here’s the longer-term version of this chart:

There have been (justified!) complaints about corporate profits siphoning off almost all economic gains since the 1990s – which now look like molehills compared to recent mountains.

Another good way to look at this is through labor’s share of productivity gains, normalized to 100 as of the last quarter just before the pandemic began:

The labor share increased sharply and is still 1.2% ahead of the end of 2019. Even as of the latest measurement (Q1 2023), it is still ahead of any time during the last expansion from 2009-2019

But measured over the longer term, labor’s share is still pitiful:

And even by 1990, labor’s share of productivity gains had been gradually declining since the end of World War II.

Simply put: Labor was gifted with massive stimulus in response to the pandemic in 2020 and 2021. And over time, corporations with market power siphoned off the lion’s share of those gains.