– by a New Deal Democrat

We started another month of data with bad news in two leading sectors.

The ISM manufacturing index has shown a contraction since November, and its more leading new orders sub-index since September. And it did so again in February, with the headline index rising slightly to 47.7 and the new orders index rebounding from a dismal 42.5 to 47.0. But since both numbers are below 50, they still show contraction:

In the past, the ISM said numbers below 48 were most consistent with a recession.

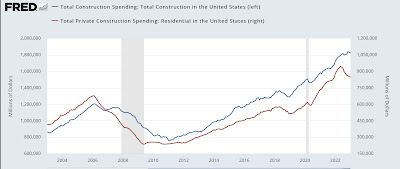

Meanwhile, construction spending for January also fell by -0.1%, with more leading private housing spending down by -0.6%:

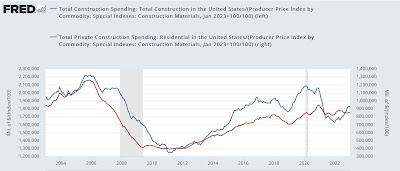

Even after accounting for construction materials prices, which fell by -0.1% in January, “real” housing costs fell by -0.5%:

Finally, in a bit of relatively good news, it looks like the motor vehicle manufacturing crisis may have abated somewhat, as 15.7 million cars and light trucks were sold on a year-over-year basis in January, the highest number since June 2021 (below graph normalized to 0 to better display comparisons):

A more typical pre-pandemic expansionary reading would have been between 17.0-18.0 million units per year, so this is still a deficit, but it’s much closer to a normal range than we’ve seen in the past year.

When February wages are reported a week from this Friday, the leading manufacturing and construction jobs sectors, none of which have declined so far, will be of particular importance.