– by a New Deal Democrat

New home sales are very loud and heavily reviewed, which is why I pay more attention to single family permits. But they have one important value: they are often the first housing indicator to turn both upside and downside.

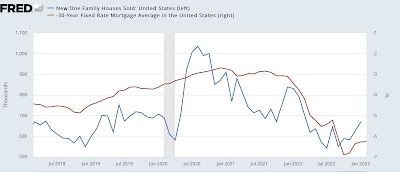

And it increasingly appears that new home sales have already bottomed out for this cycle. In January, they rose 45,000 year-over-year to 670,000. This is their second consecutive strong monthly advance and 127,000 above the low in July (blue in the chart below). This is largely a function of the lower mortgage rates we’ve seen over the past few months, shown in red, inverted, below:

With mortgage rates rising over the past few weeks, we will find out in the next month or two if this positive sales trend can be sustained.

Meanwhile, for the first time since before the pandemic, the average price of a new home fell -0.7% year over year (gold in the chart below). Since the prices are not seasonally adjusted, this is the only valid way to look at them. For comparison purposes, I also show sales (in blue) on a year-over-year basis:

Prices follow sales with a lag. Year-over-year sales peaked in 2020 with a secondary peak in early 2022. Prices peaked in 2021 and gains have been slowing since then before finally turning negative last month.

The last time I looked at new home sales a few months ago, I noticed that new home sales “suggest [economic] the downturn may not be that long (the Fed is willing, of course).” This continues to be true.