– by a New Deal Democrat The ‘gold standard’ of jobs data

The QCEW Q3 2022 preliminary estimate was released yesterday. Although the monthly non-farm payrolls report gets all the glory, it is only a survey. The QCEW is an actual count of approximately 95% of all businesses paying unemployment benefits – but it is reported with a lag of about 6 months and is not seasonally adjusted.

Exactly “how” weak and strong they are depends entirely on how one adjusts seasonally. Overall, June was extremely weak, only better than 2009 since the turn of the millennium, while July was extremely strong, only weaker than 2020 and 2021. The two months together are also stronger than each year since 2001, except for 2020 and 2021. More on that below.

But first, here’s my big problem: I remain concerned about why QCEW, which is the gold standard, is so consistently below the year-over-year growth comparisons in the CES survey for the full year (so far) starting in September 2021.

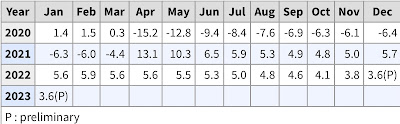

Here is the year-over-year change in the monthly QCEW at the beginning of 2020:

And here are the same data for private nonfarm payrolls:

As I wrote above, note that in September 2021, the year-over-year change in QCEW was 4.8%, while that of nonfarm payrolls was 4.9%. It’s not a big deal, but the private nonfarm payrolls survey’s excess productivity continued to strengthen throughout 2022, while there was a 1.3% deviation in June, with the QCEW rising just 4.0% year-on-year. but private nonfarm payrolls rose 5.3%. This continued through the latest Q3 2022 QCEW data.

Let’s see how different seasonal adjustment methods affect the monthly data.

If I take the seasonally adjusted CES data through March 2021 as gospel and apply the annualized QCEW growth rates starting there, I get a Q2 that adds a total of 45,000 jobs, but then a roaring Q3 that adds 884,000 jobs seats in July, 750,000 in August and 733k in September.

On the other hand, if I take the QCEW numbers for each month since Q3, compare to the closest matching QCEW numbers over the previous 20 years, and then average how CES seasonally adjusts those numbers, I get +1.2-1.3 million over July, but only about +175k in August and +150k in September.

The first method gives me a seasonally adjusted CES # of +2,367,000 jobs added in Q3, while the second gives me only +1.7 million jobs added.

Finally, if I’m to follow my rule of thumb for non-seasonally adjusted data, which is that a 50% or more drop in the growth rate over a 12-month period means that the data has actually turned negative, it shows that and April (5.0% vs. 11.7% in 2021) and May (4.7% vs. 9.7%) likely saw actual job losses followed by a recovery thereafter.

The large disparity between the two measures may be a problem for many strong new sole proprietorships (since the self-employed don’t pay unemployment insurance), but the Census Bureau really needs to address this ongoing problem.