– by a New Deal Democrat

The February JOLTS report showed a weakening of almost all major trends.

The strongest component of the entire series is vacancies. I tend to put less weight on this because there is enough evidence that companies have “gamed” this metric either to build a bank of CVs or otherwise suggest that their growth is strong (whether or not this is actually the case ). Well, despite that, vacancies (blue in the chart below, normalized to 100 as of February 2020) fell by -632,000 to 9.931 million, the lowest number since spring 2021. Actual hiring (in red) fell by -164,000 to 6.163 million (also the lowest since spring 2021), while quits (gold) increased by 146,000 to 4.024 million:

Note that an increase in the number of voluntary departures is a good thing because it indicates the confidence of the person leaving that they can find a new job relatively easily. But even with the increase in February, departures remain below their monthly levels since 2021-early 2022.

For comparison, here’s the rest of the history of all three series until the pandemic:

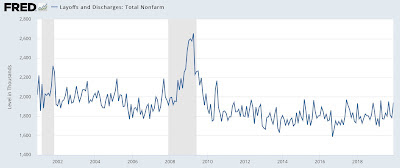

Finally, layoffs and layoffs decreased -215,000 to 1.504 million, also good. But this number only reverses January and brings us back to recent levels. The general upward trend (negative) is clear:

Again, for comparison, here’s the rest of this series:

Non-farm payrolls will be reported on Friday, March. Since initial jobless claims remain so positive, I don’t expect this number to weaken significantly, but a continuation of the slowing trend remains likely. I will pay particular attention to leading sectors such as manufacturing and housing to see if they have turned negative.