– by a New Deal Democrat

No major economic news today, but there will be a few important updates tomorrow, including real retail sales and industrial production for April, as well as non-deflated total business sales (manufacturing, wholesale and retail combined) for March. They will give us important updates on the manufacturing side of the economy, so let me review now.

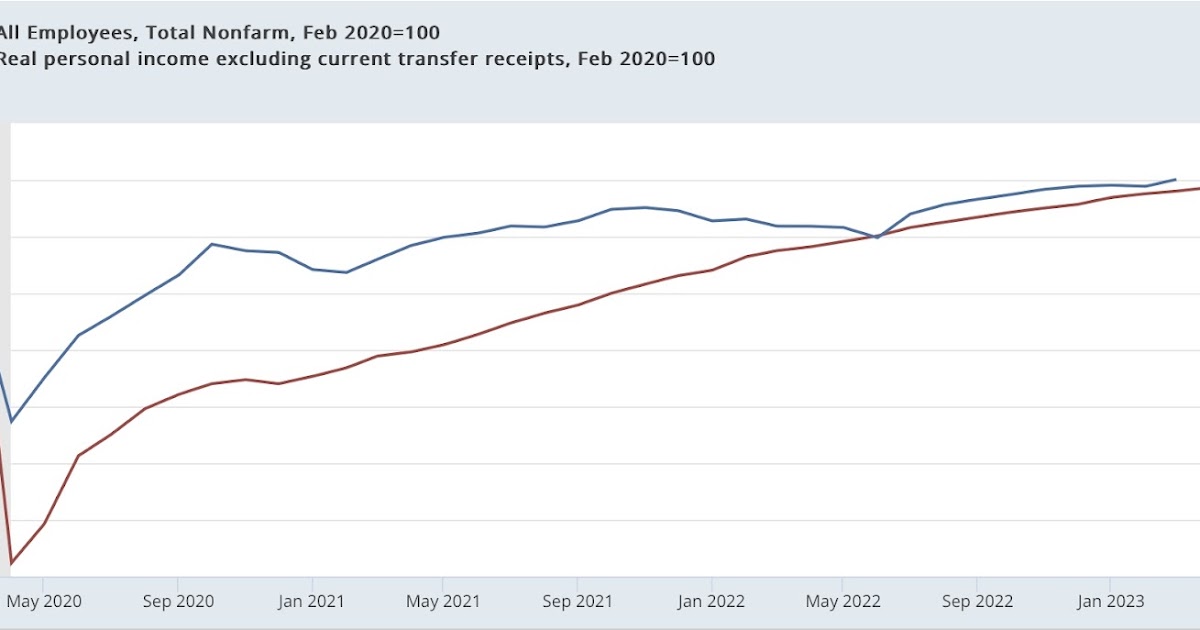

The consumer side of the economy continues to expand as jobs (red) and real incomes excluding government transfers (blue) continue to grow, albeit at a slower pace:

The big matching indicators for the manufacturing side are industrial production (red in the charts below) and real manufacturing and trade sales (blue), the quarterly % changes (to reduce noise) in which I show below, along with the manufacturing subset of industry production (gold) for 50+ years before the pandemic:

Typically, three months of growth quickly turns into three months of contraction as we head into recession. The exceptions are several shocks in oil prices (1974, 1990) and the recession created by the Fed’s Volcker (1981).

Here’s the monthly % change update for the last 18 months (yes, it’s noisy):

I’m showing this on a monthly basis since we don’t yet have full data for the first quarter of 2023. Note that industrial production and its manufacturing component remained near zero on a monthly basis, while real sales were negative last spring and have recovered somewhat subsequently.

The reason for the decline and recovery in real total sales has everything to do with oil and gas prices, whose recent course is as follows:

With that in mind, let’s now look at the same monthly figures for production and total sales, normalized to 100 just prior to Russia’s invasion of Ukraine. Note that I also include gas prices (grey, with volatility downscaled) to show the impact on real total business sales of the big price spike due to Russia’s invasion of Ukraine and then the big drop , as the West adapts:

Both total and manufacturing output may have peaked late last year, while total real sales declined in February (latest data available) from their peak in January.

Real retail sales make up about 1/3 of real total sales, so tomorrow’s retail sales report will give us the first indication of April, while the nominal total business sales report, adjusted for both producer and consumer inflation, will give us more detailed information about March.