– by a New Deal Democrat

The subject of my weekly “high-frequency” update on economic indicators over the weekend was the sudden deterioration in some measures of financial stress.

Tomorrow we’ll find out that home prices, as measured by both the FHFA and Case Shiller, have declined further and that increases have been significantly lower than those measured by the CPI, and on Friday we’ll find out two of the NBER’s important measurements: real personal income and spending, and real manufacturing and trade sales are, but since there’s no big news today, let’s look at those indicators of financial stress I mentioned above.

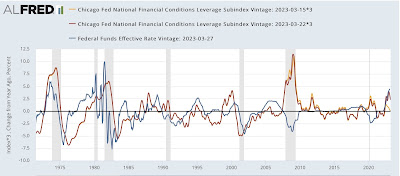

First, the leverage sub-index of the Chicago Fed’s financial conditions index was heavily revised last week (from gold to red in the chart below) to show that leverage is now tighter than it has ever been shortly before or during recessions (compared to Year-over-year change in Fed rate, blue, for comparison):

This tells us that credit has actually been quite tight over the past year and especially over the past few months.

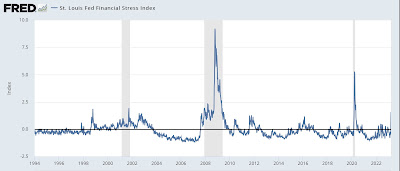

Second, the St. Louis Fed’s financial stress index, which was below zero, ie. stress-free until a week ago, it suddenly shot up to levels not seen outside of the last few recessions (see bar at far right) except for the 1998 Long-Term Capital Management crisis:

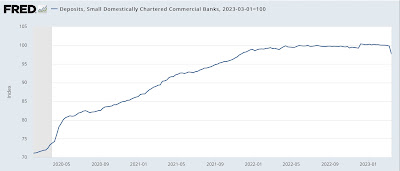

Third, in the last two weeks, 2.3% of all deposits were withdrawn from smaller commercial banks:

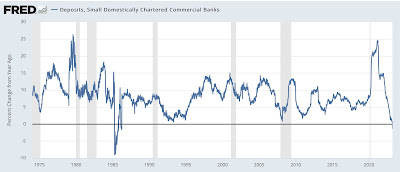

The only other time, apart from the last week, that annual commercial bank deposits were negative was in 1985-86:

If you have significant money on deposit, whether in savings, checking or money market accounts, it would be a good idea to find out what the highest interest rate a bank in your area is paying for new money and then go to the current your bank and demand they match that rate or you’ll withdraw your money. Especially if your bank has been rude enough to keep paying almost non-existent interest, chances are very good that you’ll get what you want.

It’s getting harder and harder to find any signs outside of employment that aren’t flashing warning signs of a recession in the near future, if it isn’t already here.