– by a New Deal Democrat

I’m increasingly of the opinion that right now the only two economic data series that matter are non-farm payrolls and the personal consumption expenditure deflator. That’s because almost every other important indicator of the economy is either unchanged or declining. But payrolls continue to roll (as evidenced by yesterday’s initial claims report, which shows layoffs are figuratively non-existent). And the PCE deflator, which covers a wider range than the CPI, continues to help two coinciding indicators important to the NBER, namely real personal income and real manufacturing and trade sales, stay in the plus column.

Evidence of this is this morning’s report on new durable goods manufacturer orders for February. The broad measure (blue in the graphs below) was down just 1%, while the main measure (red), which is less noisy, was up 0.2%:

Both are below their December and August 2022 highs, respectively. Over the past few months, the broad measure has been trending lower, while the major measure has been basically flat.

New orders for durable goods have long been recognized as a leading indicator. Here’s a longer-term view of the last 25 years:

Their record is certainly not perfect. The core measure continued to rise well into the Great Recession, and both fell sharply in the 2015-16 industrial recession (it wasn’t a true recession because consumers continued to spend cheerfully, so employment also continued to grow).

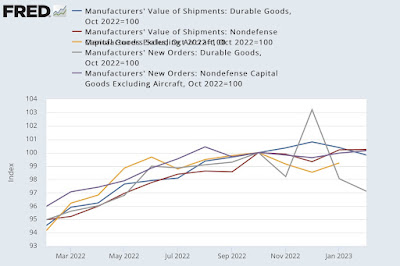

Anyway, in the chart below I’ve also added the value of total actual manufacturer supplies and supplies of “core” manufacturing goods, as well as *nominal* manufacturer sales, all normalized to 100 as of October 2022:

The slowdown in growth, followed by an actual decline in the broad measures of orders and supplies, is evident, as is the flattening in the two “core” measures, down just 0.1% and 0.2% respectively since October.

Nominal producer sales (gold) in January also fell -0.8% from October. This is where the PCE deflator comes into play. Because while there was no break in just “real” manufacturer sales, real manufacturing and trade sales (which also include wholesale and retail sales and are counted by the NBER) rose 0.6% as of its last reading in December.

In other words, the entire range of production and distribution of goods in the U.S. economy (including industrial production) is either flat or falling—except for those two measures (real personal income and real production and trade sales) that take into account report the large producer price deflation since June and the PCE deflator. More on that next week as we await the February PCE report next Friday.