– by a New Deal Democrat

As I’ve indicated several times recently, I currently consider the Personal Income and Expenses report equal to the Employment report as the most important monthly data. For March, it was a mixed bag.

In nominal terms, personal income rose by 0.3%, and personal expenditure remained unchanged. As the applicable deflator rose 0.1%, real personal income rose 0.2% and real personal spending fell by less than -0.1% (also rounded to unchanged) for the month.

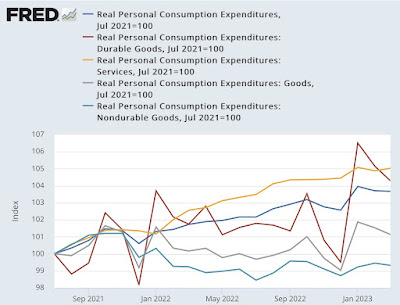

Since the start of the pandemic, real incomes have increased by 4.0% and real spending has increased by 7.6%. Since much of this was skewed by several rounds of stimulus, here’s the view normalized to 100 as of July 20:

Real personal spending rose relatively consistently while real personal income fell and then rose again as gas prices rose and fell last year:

In addition, the personal savings rate rose slightly again to 5.1%, which is good for individuals but, due to the ‘savings paradox’, bad for the economy as a whole.

Digging into some further details, there was a lot of dancing around the May post yesterday that real spending in the first quarter GDP report increased by 3.4%, a very healthy number. But I noticed that the quarterly increase was well below the monthly increases for January and February, so I suspected we’d see either a big drop today or some significant downward revisions – and we did, especially for February, as shown below:

Basically, the additional seasonal distortions around the post-pandemic holidays gave us a big downside in November and December and a big upside in January. Compared to September and October, February and March increased by only +0.6%.

Breaking down real personal spending further by purchase type, we see that real spending on non-durable goods from July 2021 actually declined, while total spending on goods rose by just 1%. The big increases since July 2021 are in services and durable goods (mainly autos), which fell sharply in November and December and then rose sharply in January:

In other words, the lion’s share of the big quarterly jump in consumer spending in yesterday’s GDP report was the jump in car spending in January, driven by seasonality.

Finally, let’s turn to the indicators the NBER uses to determine the beginning and end of a recession, two of which were updated this morning.

The good news is that real personal income minus government transfers (red in the chart below) rose 0.3% in March to a new high. The bad news is that real manufacturing and trade sales (blue) for February were down -0.4% from their recent peak in January:

Note that industrial production, perhaps the most important matching indicator, remained down about -0.5% from the September period on an annual basis, real personal income less government transfers rose 2.1%, real production and trade sales were up 0.1% and industrial production rose 0.5%:

The historical record of more than half a century shows that when all three matched indicators were at their current year-over-year levels, with one exception we were already in recession:

The only exception was 1989 when we were 6 months old.

To summarize: there was good news for real personal spending on services and for real personal income excluding government transfers. Subject to further revisions, it is unlikely that the NBER will ignore rising non-farm payrolls and declare that there was a cyclical peak in January.

But news on real personal spending on goods was negative, as were real manufacturing and trade sales for February. Personal savings increased in line with consumers becoming more cautious ahead of the recession. And yesterday’s good Q1 GDP news on consumer spending turns out to be mainly a January car-buying boom.