In particular, two of my favorite indicators are based on “fundamentals”. Basically how much the average American earns and how much they spend. Needless to say, we want both to increase. This is because, as I have often said, consumption leads to employment. If Americans are cutting back on spending, job cuts will soon follow.

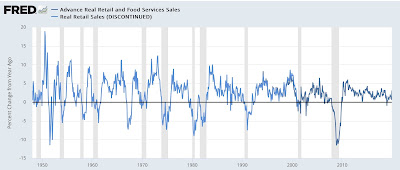

Since consumption leads, let’s start with spending, ie. actual retail sales on an annual basis. This data series goes back 75 years. And it was very reliable. Here is the graphic:

Pandemic aside, real retail sales have *always* been negative on an annualized basis within about 6 months before the recession started, except twice in the 1950s when they were negative on an annualized basis of 4 and 5 months into the recession.

There were some false positives (13 total) where negative monthly readings on an annual basis were not associated with a recession, but most were never worse than -1.0% on an annual basis (the exceptions being 1951-52, 1956, 1966-67, 1987 and 2002). Also, most of the 13 times lasted only 1 month and only 3 lasted more than 2 months in a row (1951-52, 1966-67 and 2002).

In short, even a one-month negative reading on a year-over-year basis is a yellow flag that a recession may be near, and if it lasts more than 2 months with at least one negative reading of more than -1.0%, a recession has almost certainly either started or is about to start over the next few months.

Let us now turn to employment in the form of real aggregate wages for non-supervisory employees. In other words, in real terms, the total take home American working/middle class take home. This has 60 years of experience and is also very reliable:

There were *no* false positives ie. when the indicator signaled but there was no recession. There have been 5 times when the indicator did not turn negative until several months into a recession: 1970 (4 months), 1974 (3 months), 1981 (3 months), 2001 (1 month), and 2008 (5 months). But with the exception of 1981, in the remaining 4 episodes, this indicator was in a clear and serious downward trend during those months.

Now let’s see what the two looked like together in the 50+ years that existed before the pandemic:

This shows that if both indicators are positive, you can be sure that you are not in a recession. With the sole exception of one month in late 2002, if both are negative, you can be sure you are either just before, during, or coming out of a recession. And often real retail sales have turned negative several months before real total wages.

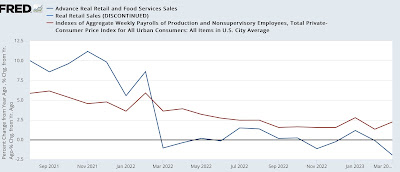

Now let’s look at the last 18 months:

Real retail sales have been negative on an annualized basis for 7 of the past 13 months. I dismissed last spring’s negative results because they contrasted with the spring growth in 2021 stimulus spending. But 4 of the last 5 months were also negative, and last month (March) at -1.9%. Putting the two measures together, with the exception of 1966-67 and perhaps the near-double decline since late 2002, there has never been a time in the past 60 years when such a large decline for that length of time has not signaled a recession.

Most importantly, real aggregate wages are currently still positive and not declining. Since, for reasons I discussed last week, I expect consumer inflation to only be around +3.2% y-o-y after June, for total real wages to turn negative, there would have to be a pronounced slowdown in either hours or labor places, or wage growth, or a combination of the three.