– by a New Deal Democrat

Yesterday I came across a post on Seeking Alpha from the Chief Economist of a major trading platform who probably makes in one week what I pocket in a year from my writing, who wrote:

“if a person loses their job, they are likely to spend less. If someone witnesses colleagues losing their jobs, they can cut costs. If extended family members lose their jobs, expenses may be reduced.

Here’s their accompanying graphic:

Note the headline: “consumption still growing because jobs expand” This is an argument I saw many times during the Great Recession: as more and more jobs were lost, it was certain that people would spend more and more – a little.

Except for one thing: it’s generally completely wrong. Generally speaking, in recessions prices fall more (or rise more slowly) than wages. Interest rates paid on things like mortgages and car loans are falling. As a result, even though jobs continue to be lost, bargains become attractive to some people who work, and they go out and spend more. Likewise, even as jobs continue to be added to expanding economies, if prices and interest rates rise more than wages (as they usually do at the end of an expansion), consumer spending generally begins to decline.

In short, it is changes in consumption that lead to changes in employment, as sales growth or shortages cause employers to increase or decrease their hiring and firing.

Even in short: consumption leads to employment, not the other way around.

Since I haven’t shown the graphs to support this connection in quite some time, let me repost the evidence.

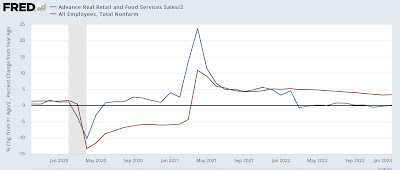

Here’s a graph going back 75 years to 2019 of the year-over-year change in real retail sales (blue, /2 for scale) versus nonfarm payrolls (red), averaged quarterly:

Although there is no exact 1:1 correspondence, the graphical evidence is simply compelling that year-over-year peaks and troughs in consumption lead to peak employment growth or losses of one or more quarters. For 75 years.

Since pandemic 2020 would have made everything else before seem like spins, here’s the update since then:

Costs came first; then job growth. After that, annual consumer spending was flat and job growth slowed.

Which brings me to a critique of a second article I read yesterday, by Lance Roberts, formerly (if I recall correctly) of Time magazine, a conservative commentator who is often my poster child for “someone is wrong on the internet.” Except most of his current arguments – that the Fed is highly unlikely to give us a “soft landing” – are correct. After noting that both sales growth and job growth are slowing, he wrote:

“While most of the job recovery was hiring employees who were laid off, the surge in stimulus-driven retail sales will eventually feed back into employment growth. The reason is that ultimately people can only spend what they earn. As you can see, the gap between retail sales and employment is unsustainable.”

I agree. What I object to is his graphic accompanying the point shown below:

Note the different left/right scales. The chart shows a 1:1 relationship between retail sales growth and job growth. But this is misleading because, as I showed above, real retail spending has tended to rise or fall with twice the change in jobs. So let me show you the data since modern retail sales streaks began in 1992 another way.

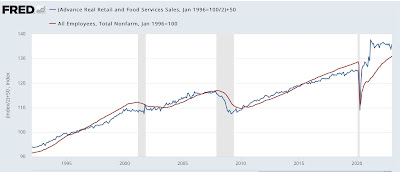

The chart below normalizes both real retail sales and nonfarm payrolls to 100 at roughly mid-cycle for the 1990s. This is because, as a result of the lead/lag relationship, sales grow relatively faster than jobs earlier in an expansion and less rapidly later. Then I do a little math trick: I divide the sales by 2 and add 50 to the result to get the progress and decline in actual sales that equates to a change at half the rate of jobs:

Note that the “gap” between job growth and retail sales growth looks significantly smaller than in Roberts’ chart. Here’s a close-up:

Over the past 2.5 years, job growth has accounted for about 8/9 of what is needed to return the relationship to trend. So, to be clear, I agree with Roberts’ statement that “the rise of . . . retail sales will eventually return to job growth,” or rather, the two series will converge.

Exactly where and when this convergence will occur, we do not know.