– by a New Deal Democrat

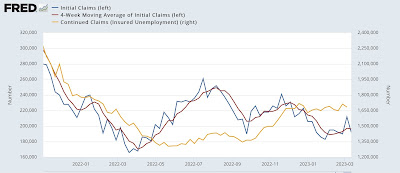

Initial jobless claims fell -20,000 this week, back below 200,000 to 192,000. The 4-week average fell from -750 to 196,500. Continuing claims, delayed by one week, fell -29,000 to 1.684 million:

For all intents and purposes, it’s still the case that “nobody” is getting laid off.

As the chart above shows, we are now almost a year after the lowest level of new jobless claims in history. Needless to say, this affects the year-over-year comparisons, which are now higher:

On a weekly basis, new jobless claims were 8.5% higher than a year ago, and ongoing claims were 5.6% higher. The much more important 4-week average of new claims was 4.1% higher.

None of this is a recession warning signal. I would need to see the 4 week average at least 10% higher and last more than a month at those levels to even raise a yellow flag.

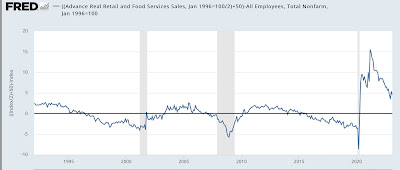

Finally, to follow up on the jobs vs. retail sales that was reported yesterday, a corollary to the observation that consumption leads to jobs is that retail sales tend to grow faster than jobs to begin with of the expansion but grow more slowly than jobs at the end of the expansion. The chart below subtracts the rate of job growth from the rate of retail sales growth to show that:

When the line is rising, sales are growing relatively faster than jobs. When the line declines, jobs grow faster than sales. The “zero” line on the chart is the velocity at roughly the midpoint of the last 3 extensions.

There has been a huge deficit in job growth compared to sales growth due to the pandemic. Since then, there has been tremendous job growth to fill this gap in the long-term trend. It’s still about 4.4% from the close, historically still very wide, but narrowing rapidly. Remember, the gap can be closed by a decline in sales, an increase in jobs, or both.